Ito Process Stock Price

If a stock price follows a Markov process which of the following could be true AWhenever the stock price has gone up for four successive days it has a 70 chance of going up on the fifth day. ITOEF Other OTC - Other OTC Delayed Price.

Chapter 20 Brownian Motion And Ito S Lemma Ppt Video Online Download

A stock has a current price 20 and 020 040 per year.

Ito process stock price. Because stock price returns are supposed to have a positive trend plus random deviations independent from past deviations in line with the efficiency hypothesis of stock markets. Ft SterTt where St is the spot price of the stock at time t. The stock prices provided a new formula for the valuation of a European style call option that rules out negative option prices.

Stochastic Integral Its Lemma Black-Scholes Model Multivariate It. For moving from the simple Taylor expansion second-order terms have to be considered using the expression of AS. About the Ito Vault cryptocurrency forecast.

Denotes the continuously compounded expected return on the stock. DS t S tαdt σdZ t where α. Having financial market with safe rate r and risky asset S with dynamics under physical measure P.

4232021 The shares are currently trading at 6250. The Stock Price Process. It is calculated by dividing a companys price per share by its earnings per share.

The RHS is a constant plus Ito integral which is a martingale. BWhenever the stock price has gone up for four successive days there is almost certain to be a correction on the fifth day. Regard F as a function of s and t ie F Fst serTt.

For stock prices the return is randomly distributed normally and iid. The process for a stock price. Hence the stochastic process ϕtSt is the value of the portfolio ϕt at time t.

The stock price follows an Ito process with drift and diffusion terms dependent on the stock price and on time which we summarize in a single subscript. We must consider them as a collection of random variables Obviously the order is important - when you enter at time j and exit at time k you care about another random variable A collection of time indexed random variables - a stochastic process. The PE ratio or price-to-earnings ratio is the one of the most popular valuation measures used by stock market investors.

1 l o g S T l o g S t μ σ 2 2 T t σ W T W t what should be equivalent to. Stock price as a process Prices at different times. Thus St S0exp Z t 0 σudB u 1 2 Z t 0 σ2udu is a martingale.

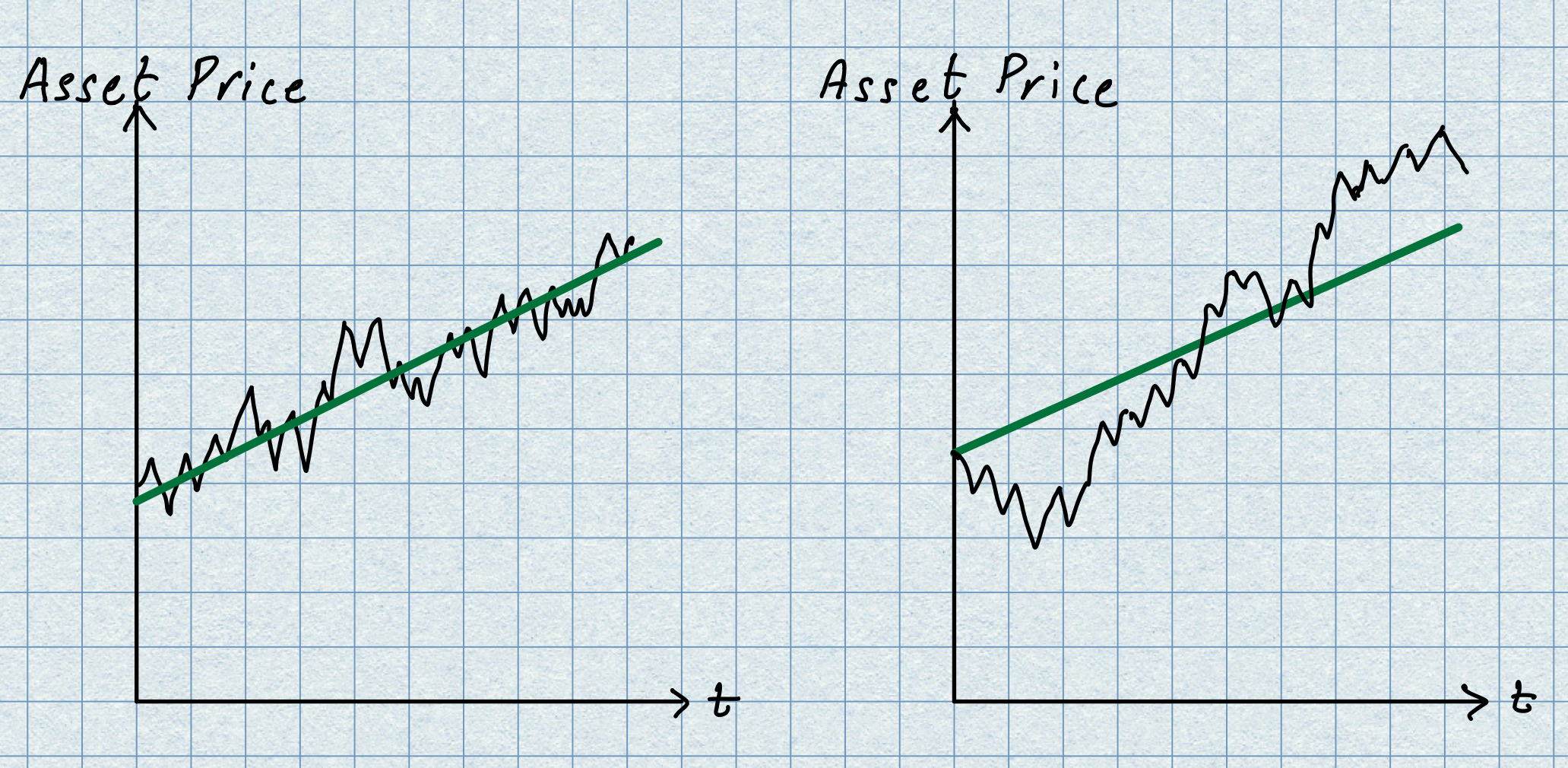

Say for instance that you would like to model how a certain stock should behave given some initial assumed constant parameters. D S t S t μ d t σ d W t. The stock price process is a special case of an Ito process.

It is an important example of stochastic processes satisfying a stochastic differential equation. We present both the Ito and Stratonovich interpretations of the. Let ϕt be a trading strategy denoting the quantity of each type of security held at time t.

Boness 1964 improved the model of Sprenkle by considering. Let Ft be its forward price at time t 0. A good idea in this case is to build a stochastic process.

Ito Vault has been showing a declining tendency so we believe that similar market segments were not very popular in the given period. Find its expected price and variance in 1 year from now. As of 2021 May 19 Wednesday current price of VSPACEX is 906709 and our data indicates that the asset price has been in a downtrend for the past 1 year or since its inception.

Trading and the Ito Integral Consider an Ito process dSt t dt σt dWt. If α 0 then dS t σtStdB t which is the same as St S0 Z t 0 σuSudB u. The stochastic process followed by forward stock prices Consider a forward contract on stock paying no dividends maturing at time T.

Processes SDEs SDEs and PDEs Risk-Neutral Probability Risk-Neutral Pricing 15450 Analytics of Finance Fall 2010. And dw is a Wiener process having its variance is given by. In particular it is used in mathematical finance to model stock prices in the BlackScholes model.

Stochastic processes are an interesting area of study and can be applied pretty everywhere a random variable is involved and need to be studied. April 20 1111AM EDT.

Using Ito formula it is straightforward to derive the below equation. This process models a stock price with time-dependent instantaneous mean rate of return αt and volatility σt. Stock Prices The original paper by Black and Scholes assumes that the price of the underlying asset is a stochastic process S t which is solves the following stochastic differential equation in the differential form.

St is the vector of security prices at time t. A stock price is currently at 40 At the end of 1 year it is considered that it will have a normal probability distribution of with mean 40 and standard deviation 10 8. 5500 000 000 At close.

3302003 A geometric Brownian motion is a continuous-time stochastic process in which the logarithm of the randomly varying quantity follows a Brownian motion with drift. ϕt dSt ϕtt dt σt dWt represents the change in the. What is the log-stock price.

F s erTt 2F s2.

Pdf Stochastic Ito Calculus And Numerical Approximations For Asset Price Forecasting In The Nigerian Stock Market

Chapter 3 Aseet Price Modelling And Stochastic Calculus Mathematics Of Financial Derivatives

Comments

Post a Comment