Ito Lemma Stock Price

Processes SDEs SDEs and PDEs Risk-Neutral Probability Risk-Neutral Pricing 15450 Analytics of Finance Fall 2010. Also follows geo-metric Brownian motion.

1 Shows The Evolution Of A Stock Price In A Geometric Brownian Motion Download Scientific Diagram

DG G S S.

Ito lemma stock price. There are no dividends. Stock Price at Start of Period Random Sample for Change in Stock Price S. 682019 With the help of Itos lemma it is easy to solve the geometric Brownian motion which is used to model stock price movement.

Itos lemma can be used to model functions of other stochastic processes. Let us consider G is a function of two variables x and t. DS fjiS dt crS dz What is the process followed by the variable Sl Show that S.

Itos Lemma Derivation of Black-Scholes Solving Black-Scholes Stock Pricing Model Recall our stochastic di erential equation to model stock prices. Let Gbe a function of St. What is the expected value of S.

1082020 We could apply Itos lemma to G S in order to obtain arithmetic Brownian motion however using G lnS which gives a nice property that the stock price is strictly greater than 0. Log-normal distribution of stock prices. All securities are infinitely divisible.

Itos lemma states that Gfollows the generalized Wiener process as follows. Trading is continuous and short selling is allowed. In order to solve a partial differential equation GBM we need to appreciate Itos lemma.

8252017 I am able to replicate steps and arrive to the option price using Black Scholes framework. Suppose that we model the price of a stock using a stochastic. D G μ σ 2 2 d t σ d z.

However it seems that from d S μ S d t σ S d z if we. Using Its lemma with fS logS gives. Itos lemma lognormal property of stock prices Black Scholes Model From Options Futures and Other Derivatives by John Hull Prentice Hall 6th Edition 2006.

I do not think it has to do with log normality of prices. Given d S μ S d t σ S d z by applying Itos lemma to G ln. In the next section we go over a simple application of Itos lemma.

T is the current time T is the expiration time and. Stochastic Integral Its Lemma Black-Scholes Model Multivariate It. Itos lemma assume that fx is continuously twice differentiable usual differential.

The expected value of ST the stock price at time T is SeTt. DS S sdX mdt where mis known as the assets drift a measure of the average rate of growth of the asset price sis the volatility of the stock it measures the standard deviation of an assets returns and. The term structure of riskless rates is flat at r.

There is unlimited riskless borrowing and lending. 5242020 understanding of Itos lemma applied to stock price. 3302003 This is an interesting process because in the BlackScholes model it is related to the log return of the stock price.

Df fx xt dt now let xX_t from a stochastic process as described in the previous slide notice W_t is nowhere differentiable. There are no transactions costs or taxes. A stock has a current price 20 and 020 040 per year.

The stock price follows an Ito process with drift and diffusion terms dependent on the stock price and on time which we summarize in a single subscript. Find its expected price and variance in 1 year from now if the stock price follows the lognormal distribution. Itos lemma Let ftx be a smooth function of two vari-.

Price process is already a function of time and Wiener process so I wonder why do we need to apply another function ln. The stock price follows dS Sdt σSdW. On the distribution of the stock price at a given time Recall the example from class to conclude that lnS t N lnS 0α 1 2σ2tσ2t for every t In other words at any time t the stock-price random variable S t is log-normal The above means that.

Under this assumption stock price follows a lognormal. Here however I am more interested to understand at least intuitively why the ln transformation of price process is performed Ito lemma part in the first place. 0 10000 052 245 1 10245 144 643 2 10888 -086 -358 3 10530 146 670 4 11200 -069 -289.

Df fx dx if xxt is also continuously differentiable in t. Our strategy only makes sense if t is an adapted process since otherwise it contradicts the. Previously Stock price simulation we saw that stock prices can be described by geometric brownian motion GBM.

I am currently reading John Hulls book and am a bit confused about the Itos lemma when it is applied to the stock price. So applying Itos lemma to lnS first we calculate the partial derivatives with respect to t and S as follows. The Ito lemma which serves mainly for considering the stochastic processes of a function FSt t of a stochastic variable following one of the standard stochastic processes resolves the difficulty.

Itos lemma gives a derivative chain rule of random variables. Appendix 10A Derivation ofltos Lemma 225 1011 Suppose that a stock price S follows geometric Brownian motion with expected return JJL and volatility a. Concretely its often used in the analysis of derivative securities which are essentially functions of other securities.

We either buy or sell one stock hence t 1 or 1.

Idea Of Using Logarithm For Solving Sde In Black Scholes Model Quantitative Finance Stack Exchange

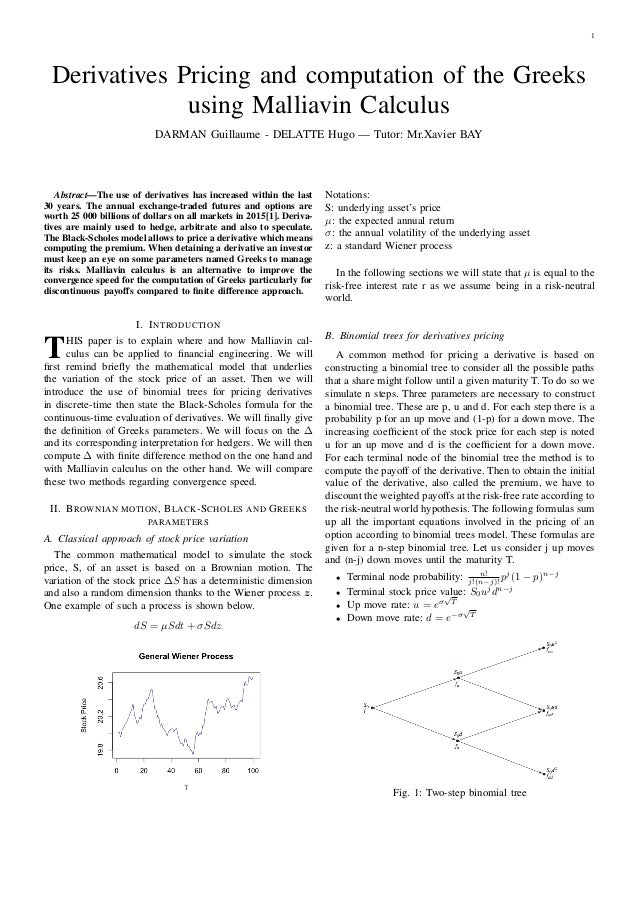

Derivatives Pricing And Malliavin Calculus

Comments

Post a Comment